The hurricane Katrina economic impact on US economy

It is always delicate to write about economic consequences of catastrophes without being seen as cynical. The aftermath of a terrorist attack or a hurricane is much more about human lives than about economics. All my thoughts are going to Americans in Alabama, Louisiana and Mississippi.

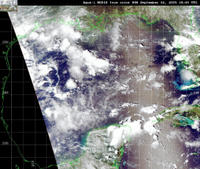

It is always delicate to write about economic consequences of catastrophes without being seen as cynical. The aftermath of a terrorist attack or a hurricane is much more about human lives than about economics. All my thoughts are going to Americans in Alabama, Louisiana and Mississippi.There are always several possible economic consequences. Immediate as well as medium term effects are both direct and indirect. Every year, at the end of the summer and in early fall, the south east region of the US is hit by tropical storms and hurricanes. Last year is considered to have been already harsh, with four major episodes. But this year started with the strongest hurricanes in decades. President Bush declared this was the worst natural disaster in the US history. For the time being, more than hundred fatalities have been confirmed, but officials declared the final number will be in thousands.

The direct immediate effect is related to the interrupted daily economic activity. During few days, or longer for some areas, no one is working the way he or she used to. Ocean-side counties of Alabama, Louisiana and Mississippi (1) represents a very small part of the US. The total population of these counties is 2.5 millions people, versus almost 300 millions for the US as a whole. They represent 0.9% of the total US population. In terms of personal income, they account for even less, with 0.7%. This means than less than 1% of the US economic activity was shut down during few days. In short, this should not be noticeable in national accounts data. Additionally, this downside effect will be offset by the following positive effect related to the reconstruction effort. It is possible to expect a temporary rise in the saving ratio when victims receive their insurance payments (estimates of the losses range from USD 9 bn to USD 25 bn, compared with USD 21 bn for hurricane Andrew in 1992), but this will be transparent in macroeconomic terms, since higher households revenues will be offset by lower earnings from the insurance industry.

If the Gulf of Mexico was not the US oil centre, there will be not more to add. But it is, for extraction of crude oil, pipeline infrastructure, and refineries. Almost half of the US oil production comes from refineries in the states along the gulf's shore. And here is the reason why financial markets focus that much on Katrina. Since the hurricane was expected, oil prices began rising few days before Katrina actually hit the coast. Even if this left the West Texas Intermediate above USD 70 per barrel, the effect is quite limited: at yesterday close, the WTI was just up USD 2.3 from a week earlier. The announcement by President Bush that strategic reserves would be used brought some relief. Additionally, for the time being, there is a lack of information about when refineries will resume production. Should this happen later than expected by the market, oil prices will rise.

There is thus a lot of uncertainties about oil prices in coming weeks. Since the US is highly dependent on oil – The Economist recently called the US and China oiloholics – further rise in the already incredibly expensive oil could disrupt economic growth. This is the reason why markets now expect the Fed to remain on hold in September, resulting in lower bond yield as well as in a cheaper dollar. It is quite impossible to be sure about what the Fed will decide in three weeks from now. On the one hand, direct economic impact does not justify a change of its current policy of removing the excess accommodation. On the other hand, the final impact highly depends on oil prices.

(1) Alabama: Baldwin, Covington, Escambia, Geneva, Houston and Mobile.

Louisiana: Cameron, Iberia, Jefferson, Lafourche, Orleans, Plaquemines, St Bernard, St. Mary, Terrebonne and Vermilion.

Mississippi: Hancock, Harrison, Jackson and Pearl River.

Write: by LuisB. 09.2005